stock option tax calculator canada

Please enter your option information below to see your potential savings. Stock Option Calculator Canadian Receiving options for your companys stock can be an incredible benefit.

Employee Stock Options Canadian Employees Tax Implications

Ad For Private and Public Companies Who Want Equity Plans Done Right.

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

. The employee includes the benefit either in the year. Option Exercise Calculator This calculator illustrates the tax benefits of exercising your stock options before IPO. The underlying stock price must exceed the strike.

The capital gains tax rate in Ontario for the highest income bracket is 2676. Remember for employees of CCPCs the taxable benefit is postponed. Day traders make a.

Currently the rate is 50. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. On April 19 2021 the federal government tabled its budget bill Bill C-30 An Act to implement certain provisions of the budget tabled in Parliament Bill C-30 which contained.

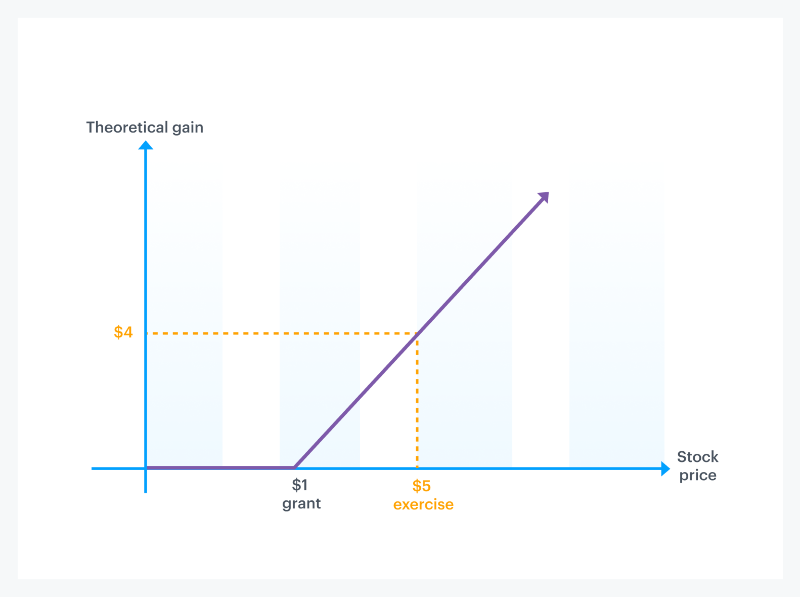

For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1. The employees benefit from exercising the employee stock option is 15 10 5 ½ under subsection 110 1 250. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

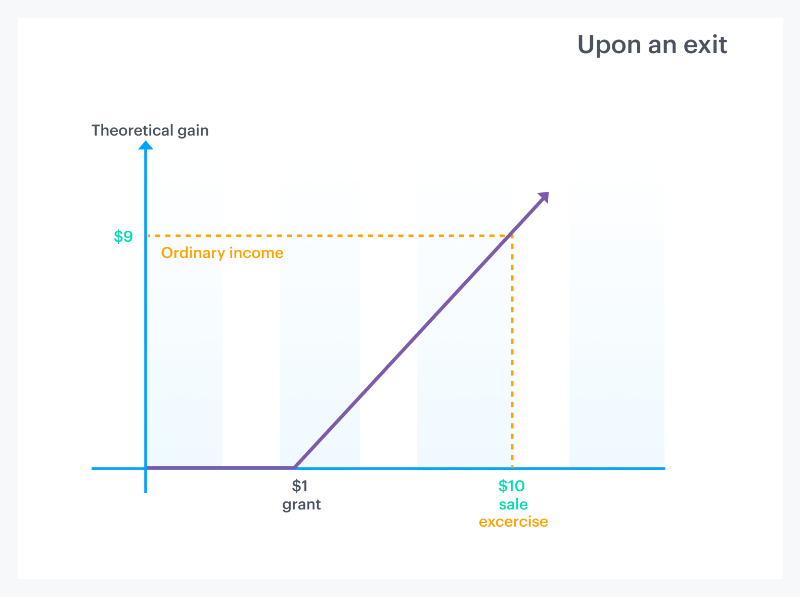

Lucky for Stacey capital gains are taxed at 50 rather than 100 like employment income so Staceys 4000 gain ie. Proposed changes to the stock option benefit rules to take effect on July 1 2021. The calculator will show your tax savings when you.

Locate current stock prices by entering the ticker symbol. You can calculate tax on stock gains in Canada by figuring out what type of investor you are what type of investment income youll be making and what your tax bracket is. 50 less 10 40share x 100 shares will mean she will pay tax on.

An option is an opportunity to buy securities at a certain price. You will only need to pay the greater of. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223.

Changes to the taxation of stock option benefits are coming this summer that. Click to follow the link and save it to your Favorites so. Even after a few years of moderate growth stock options can produce a.

The securities under the option agreement may be shares of a corporation or units of a mutual fund trust. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

The strike price is the stock price that your options were issued at. This permalink creates a unique url for this online calculator with your saved information. For this calculator the current stock price is assumed to be the strike price.

Tax calculator Tax calculator Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. Test out various options strategies and discover the contract size that works best for you. When you exercise your right to buy the shares a taxable benefit is realized for 7 share 10 minus 3.

Ad Gain access to the Nasdaq-100 Index at 1100th the notional value. The taxable benefit is the. For the average Canadian the taxable capital gain is determined by multiplying the capital gain amount with the years inclusion rate.

Under the employee stock option rules in the Income Tax Act employees who exercise stock options must pay tax on the difference between the value of the stock and the. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and.

How much are your stock options worth. Ad For Private and Public Companies Who Want Equity Plans Done Right.

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

How Stock Options Are Taxed Carta

How Stock Options Are Taxed Carta

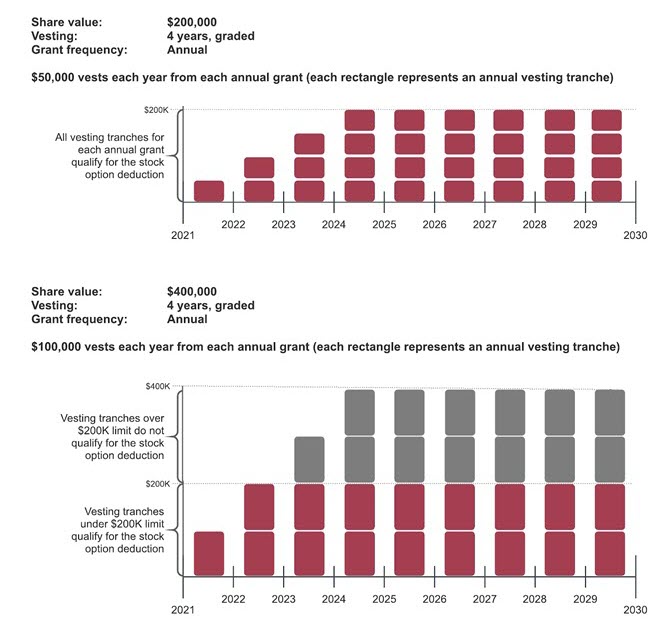

Proposed Changes To Stock Option Taxation

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Proposed Changes To Stock Option Taxation

Proposed Changes To Stock Option Taxation

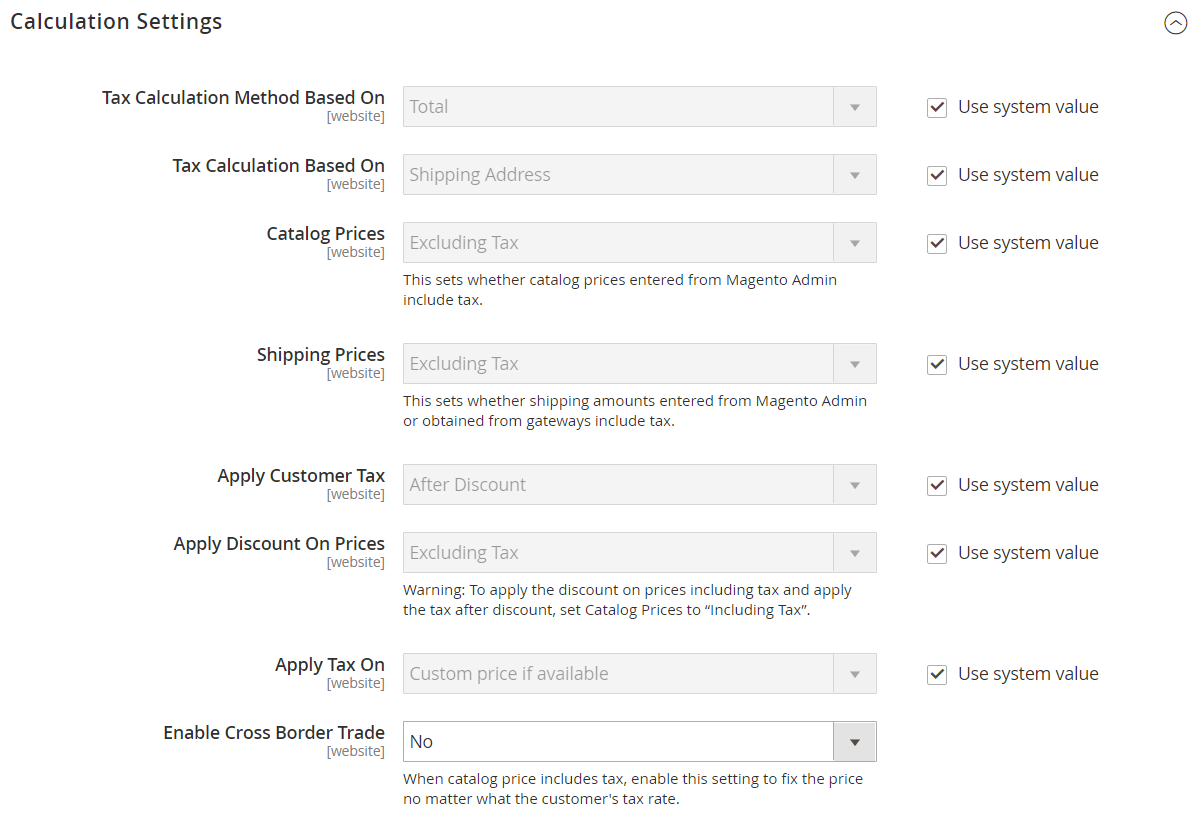

General Tax Settings Adobe Commerce 2 4 User Guide

Canada S Federal Personal Income Tax Brackets And Tax Rates 2022 Turbotax Canada Tips

How Is Yield Farming Taxed Koinly

Tax Insights New Rules On The Taxation Of Employee Stock Options Will Be Effective July 1 2021 Pwc Canada